It’s Talk Money Week! Do You Dare To Check?

This Talk Money Week (November 8-12), Lloyds Bank is encouraging us to get into the habit of checking in on our finances .

Research shows 1 in 4 people in the UK worry about their finances at least once a week… but almost half shy away from actually checking on them.

Yet financial wellbeing is the top priority for the majority (57%) of Brits – it comes in ahead of physical, intellectual, or social wellbeing.

Lloyds Bank research found only half of those questioned (55%) feel comfortable checking their finances as part of a regular routine.

A quarter (23%) of the population worry about their finances at least once a week. So the bank is encouraging consumers to think differently about their spending behaviour and develop a better relationship with their money.

Financial health check

The drive for greater financial wellbeing increases with the younger generations. One in five (22%) of 18-34 year olds want to be in more control of their finances (compared to 14% of all adults). However lack of know-how (19%), confidence (16%) and motivation (17%) hold them back.

Chris Gowland, customer financial assistance director at Lloyds Bank, said, “Our research shows the majority of Brits recognise financial wellbeing as a priority. It’s important we don’t let distractions and lack of confidence get in the way of building good money habits.

“A big part of having a better financial state of mind can come from positive conversations about money.

“Feeling financially resilient can be a real game-changer for how we feel in other aspects of life.”

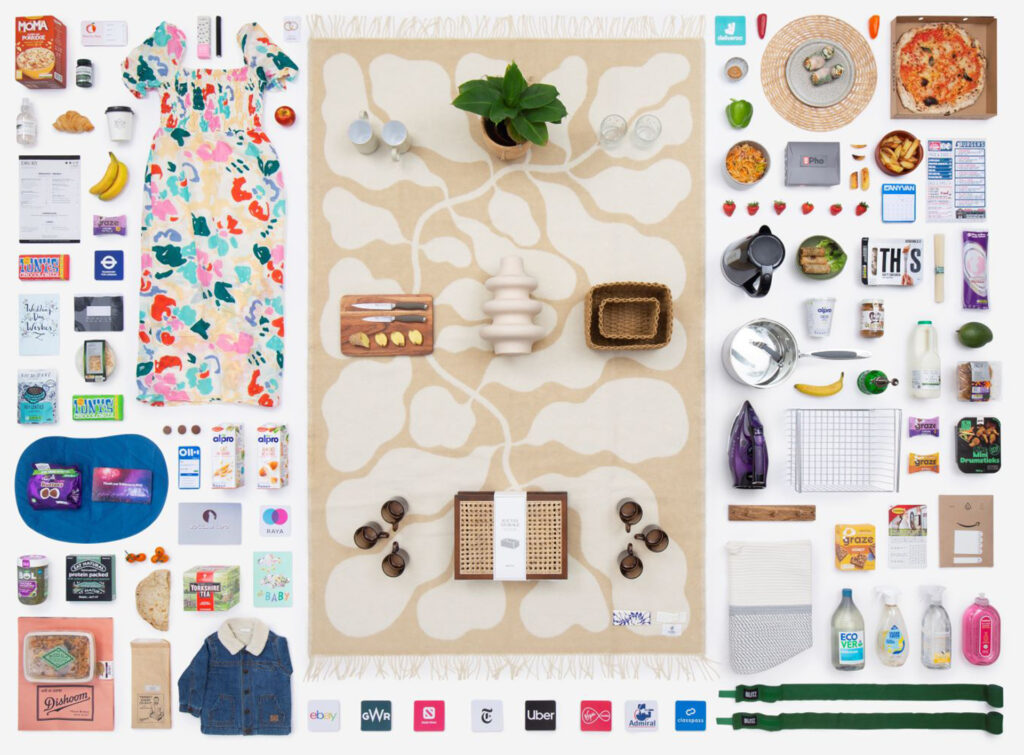

What have you bought this week? Artwork: Paula Zuccotti / Lloyds Bank. From the Making A Statement exhibition

To inspire people to build up their financial confidence and resilience, Lloyds Bank partnered with artist and ethnographer Paula Zuccotti, to visualise people’s monthly bank statements as works of art, at the Making A Statement exhibition.

The exhibition featured wall-sized displays of people’s monthly spend, bringing to life exactly where their money has gone, while championing the importance of talking about money.

Establishing financial habits

As research revealed less than a quarter of Brits set aside time to specifically complete tasks and review goals and priorities, Lloyds Bank partnered with ‘Money Whisperer’ Emma Maslin to identify how people can build financial habits into their routine.

Learn more about how to make important money conversations easier to have with our top tips from The Money Whisperer, below:

There’s no one-size-fits-all solution

Personal finance is by nature, personal, so there’s no ‘right’ way to achieve better financial wellbeing, especially as our emotional relationship with money is very unique and defined by individual experiences. Think of financial wellbeing as an ongoing journey, rather than the destination, but ensure you take consistent steps in the direction you want to travel.

Tune into your self-talk

We often have the harshest financial conversations with ourselves – listen to this voice inside your head and learn to practice acceptance of your current reality without being critical.

Bring a level of awareness to your finances

Being cognisant of what else you need to build into a better financial wellbeing routine is a critical first step.

For many people, this might just mean a daily check-in with your current account. Awareness is the first step to positive and meaningful change.

Find someone who keeps you accountable

Use friends as a ‘commitment device’ for building new and healthier financial behaviours.

Share your financial goals, hear what others are struggling with and find solutions for each other with fresh eyes. We never know if others have the same problems as us if we don’t talk about what we are going through.

Step away from the mechanics of finance

The way we approach money is programmed by our parents and caregivers when we are young, before the age of seven.

When we realise that the beliefs we hold around money and the emotions attached to it aren’t actually our own – we were conditioned with them by others – we can initiate some interesting and non-confrontational conversations with our partners and friends.

Talk Money Week, hosted by The Money and Pensions Service, will run to Friday, November 12, 2021.

Find further tips and advice on managing your money and building up financial resilience