HMRC Scams: Don’t Get Caught Out!

His Majesty’s Revenue & Customs (HMRC, or the tax office) is used as a continuous scam by fraudsters. The organisation that can demand money and give you money is a huge opportunity for scammers to use, and they do!

In this week’s Scam Watch, James Walker from Rightly and Louise Baxter from the National Trading Standards Scams Team give you the know-how that will help you avoid getting caught out.

It’s time to take control, know how to spot a scam and what to do about it.

Throughout the year there are different times when they can target scams according to what you would expect. For example, when you need to do a tax return.

Here are the key HMRC scams…

- COVID 19 refunds: get a tax refund because of COVID, you’re entitled to money back, claim now

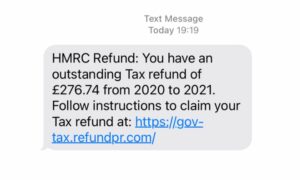

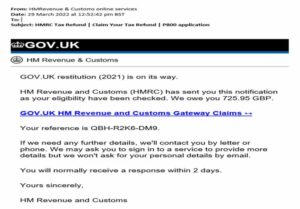

- Tax refunds: you’re entitled to a refund and your tax liability has been recalculated

- Tax bills: you have an outstanding tax liability that needs to be paid immediately

- Tax rebates: often for uniforms or home working; an organisation will supposedly reclaim money for you

- Customs duty: you need to pay customs duty for an incoming parcel as the taxes have not been paid.

Some HMRC scams are only interested in harvesting your data so that it can be used in other scams. The data being passed on may include your bank details.

Alternatively, the scammers may require you to enter a bank card number and they will take payment – that is, steal your money right out of your account.

In some versions they will install malware onto your device to monitor your usage and capture key passwords. With the call scams, they can record your screen, watch you transfer money and then empty your bank accounts after the call.

“You must act now…”

All scams have a similar theme which

- requires you to rush

- has a significant and concerning demand or

- has an amazing benefit which means you need to act now.

This is combined with either aggressive or demanding members of staff and/or the demand to transfer money.

HMRC scam attempts are made by numerous channels including emails, text messages, WhatsApp, social media and phone calls.

The phone calls are often an automated message telling you there’s an issue with your account, and “press 1 to speak with someone”. If you press 1, you are taken through to an overseas contact centre.

Help HMRC fight back

HMRC investigates suspicious calls as well as all other scam activities to do with tax. Use the HMRC scams reporting form to submit information to them.

If you are subject to any scam, then immediately get hold of Action Fraud online in England and Wales, or call them on 0300 123 2040. In Scotland, you should phone Police Scotland on 101.

Scambusters Mailbag

What do I do if someone comes to my door and I think it is a scam?

Scambusters say: “As soon as you can, close down the conversation. Do not let them into your home.

“If they are in your home and you feel threatened, make an excuse to go to another room and call the police immediately.

“If the person has left, then call the police and also call a friend or relative.

“It’s important to report incidents like this to your local trading standards officer as well. They can be reached through your local authority.”

Which emails can I trust?

Scambusters say: “Great question. Most email accounts now filter out scam and spam emails, but scammers are always changing where they send emails from so that they can get through the spam filters. You should always be on the lookout.

“If you receive an email you’re not expecting…

- Look at the email address it’s coming from. Click on the email address, so it shows as well as the name.

- The first check is: Does it look consistent? Is the name the same as the email address? If not, delete it.

- Secondly, when you hover the mouse over a link without clicking, what comes up? Does the link look consistent with the firm name and their website? If not, delete it.

- If it is, still never click on the link but instead Google and visit the website this way. If the result does not come up at the top or close to the top of Google, we would recommend not visiting it.”

Tip of the week

Always make a payment with a credit card as you have the greatest level of protection. If anything goes wrong with a purchase, you are fully covered for a refund.

Report it!

If you have received a text you think is a scam, then you can forward to 7726. Or take a screenshot and send it to report@phishing.gov.uk.

If you are receiving lots of unwanted phone calls or text messages, you can also consider removing your details from data brokers. Use your right to object to processing of your data.

You can learn more about this on Rightly to stop the sharing of your data exposing you to scams.

And remember, you can take a free training course on how to fight back against scams at friendsagainstscams.org.uk.