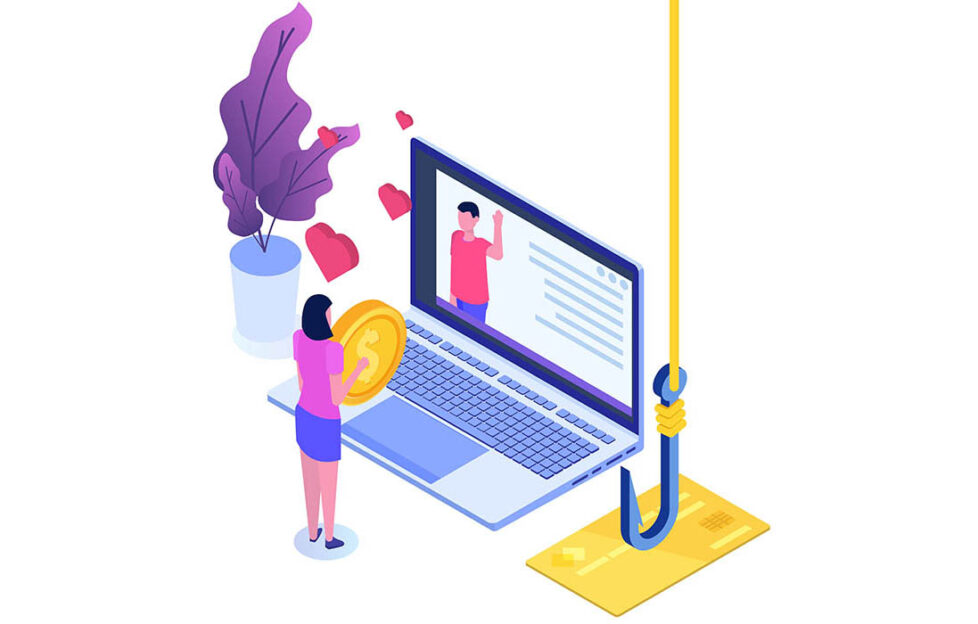

Romance Scams: Don’t Get Caught Out!

Globally, millions of people are now turning to online dating apps or social media to meet someone. In the process, users end up sharing a wide variety of personal data.

But lurking in the online shadows there are scammers ready to target the vulnerable. You may not think of yourself as vulnerable, but it’s surprising how many people get caught by the scammers.

It’s simply a confidence-trick, and involves a thief pretending to be loving and affectionate to gain the confidence of the victim.

In this week’s Scam Watch, James Walker from Rightly and Louise Baxter from the National Trading Standards Scams Team give you the know-how that will help you avoid getting caught out.

It’s time to take control, know how to spot a scam and what to do about it.

Playing the long game…

The scammer starts slowly, building trust, making up their story. But at some point, they make their move and ask for money.

They might claim to be abroad, or working on an oil rig – reasons you may not be able to meet in person. But in fact they’re sitting in a cubicle in a ‘scam factory’ alongside teams of other thieves.

The scammer will go to great lengths to gain trust and have been known to work at a scam for months, even years. They are masterful at using language to persuade and manipulate victims in order to exploit them.

Once established, the criminals gently execute their sting.

They ask for money to be sent – it may be so that they can come and visit, or for a medical bill for a fictional sick relative, or to pay off a debt.

Sometimes it’s a suggestion to make an investment, for example, a foreign property or perhaps crypto-currency.

How to avoid falling for a romance scam

Think twice before parting with your money. Here are some suggestions:

- Stop and think, ‘take five’, before sharing money or banking details

- Challenge anyone who asks for money online

- Protect yourself by letting your bank know that someone tried to con you, and report the incident to Action Fraud if you think you have fallen for a scam

- Watch out for family members and friends. Signs they could be involved in a romance scam include if they:

- are secretive about their relationship and provide excuses for why they haven’t met their online partner in person

- express strong emotions and commitment to someone they’ve only just met

- are sending money to someone they have not met face-to-face

What to do if you’ve been scammed

If you think you have been scammed:

- note all the details of the scam

- report the scam to the police (if it has taken place in the last 24 hours)

- protect yourself from further risks and check if you can get your money back, by for example contacting your bank and making them aware that you have been scammed

- report the scam to Citizens’ Advice – it can pass the information on to Trading Standards for it to investigate, and potentially take legal action against the fraudsters

- report the scam to other organisations such as Action Fraud – this increases the chance of catching the scammers

Scambusters Mailbag

I received a text message asking me for prepayment. How can I know it’s legitimate?

Scambusters say: “Unfortunately this is a tried and tested scam that catches many people out. Advance fee fraud (AFF) is when fraudsters target victims to make advance or upfront payments for goods, services and/or financial gains that do not materialise. Examples of AFF include lottery and prize draw scams, inheritance scams, fraud recovery fraud and career opportunity scams.”

Here’s some advice on how to protect yourself:

- Don’t disclose your bank details or pay fees in advance

- Be wary of potentially fake profiles on social media platforms offering jobs that do not exist

- Question claims that you are due money for goods or services that you haven’t ordered, or you are unaware of

- Do not be put under pressure to pay a fee quickly

- Be aware of recovery scams if you have been a victim in the past

- Genuine agencies never ask for fees to recover money lost to fraudsters

Tip of the week

If you get asked for money by text, remember – no reputable company will ever do that.

Remember: If you’ve received a text you think is a scam then you can forward it to 7726 or take a screenshot and send it to report@phishing.gov.uk.

If you are receiving lots of unwanted phone calls or text messages you can also consider removing your details from data brokers, ensuring that you use a right to object to processing of your data.

You can learn more about this on Rightly and stop the sharing of your data, which is what exposes you to scams. And you can take a free training course on how to fight back against scammers at friendsagainstscams.org.uk.